Terms of Business

Terms of

Business

Terms of Business

Download a PDF copy of our Terms of Business here.

INTRODUCTION

We want you to find an asset finance product that meets your needs. Our Terms of Business aim to provide you with information for you to consider before entering into an asset finance agreement.

Please read this document carefully. If you have any further questions about asset finance, you can contact us on 01633 415222 or [email protected] .

If you do enter into an agreement with us, we will ask you to confirm that:

– You were given these Terms of Business when you were introduced to us; and

– You have read them and had an opportunity to ask questions.

WHO ARE WE?

Propel provide UK businesses with asset finance so they can buy or hire equipment and vehicles for business purposes. Occasionally we provide personal asset finance to high net worth individuals.

We provide and administer finance through two legal entities: Propel Finance No 1 Limited (a company incorporated and registered in Wales with company number 10003271) and Propel Finance Plc (a company incorporated and registered in Wales with company number 04015132). Both companies have their registered offices at Unit 5 Langstone Business Village, Langstone Park, Newport, NP18 2LH.

We provide regulated finance for customers falling within the scope of the Consumer Credit Act 1974, and both Propel Finance No 1 Limited and Propel Finance Plc are authorised and regulated by the Financial Conduct Authority for this purpose. We also provide unregulated finance for customers falling outside that scope.

Customers come to us for finance from a few different routes. Some customers come to us directly whilst others are referred to us by a broker, supplier or commercial partner who do not provide asset finance themselves.

We are one of the UK’s largest independent finance providers with over 20 years’ experience. For more information about us, please go to www.propelfinance.co.uk

WHAT IS ASSET FINANCE?

Most businesses need to use assets such as equipment and vehicles to operate. The main options for financing the purchase and/or use of assets are:

– Purchase outright for cash, if you don’t have this in the bank already you will need to find a way to raise it

– Use a bank facility such as an overdraft, loan or other credit

– Rent the asset for a short period (usually less than one year)

– Take out an asset finance agreement.

In deciding which option is right for your business, you should think about:

– The type of asset that you need

– Whether you have the money to buy the asset outright

– How long you will need the asset for

– Which option is most cost effective

– The tax, VAT and accounting treatment for each option to finance the purchase or hire of the asset

If you choose asset finance, it is up to you to find a supplier and negotiate for the supply of the asset in the same way as if you were buying it outright. You may also have to pay a contribution towards the purchase price. However, most (if not all) of that price will initially be covered by the funder. You will then make regular payments (usually monthly) over a fixed or minimum period (usually three or four years) in order to repay the funder together with their charges for providing the finance.

The key differences between the two standard asset finance products which Propel can arrange for you depend on what happens at the end of the agreement; in particular, who owns the assets. In simple terms, these products are:

A Lease (Hire) Agreement

The funder will purchase the assets you have chosen from the supplier you have selected, and you will agree to hire them and pay rentals over the hire period. These rentals will typically be for the same amount.

During the hire period, you will have the right to keep and use the assets. You will have to insure, maintain and repair them and may need to replace them if they are stolen. However, you will never own the assets.

If you do not keep to the terms of the agreement, the funder can end the agreement and take back the assets and you will have to pay compensation to ensure that the funder is repaid in full.

There are a few different types of lease agreement. The hire period may be ‘fixed’, or it may be a ‘minimum’ period which means that you can continue to make payments to keep and use the asset after the minimum period has ended if you want. Payments will stay the same during an extended period unless we have agreed a different amount. If we agree a different amount, we will let you know before the start of the extended hire period.

If you have agreed with a supplier that they (or a named third party) will provide ongoing maintenance for the asset in return for regular payments, we may be willing to collect those payments from you along with your rentals and pass them on to the maintenance provider. We do not provide maintenance ourselves and so any maintenance arrangements you make will be separate from your finance agreement and your obligation to pay rentals for the assets. Also, we are not responsible for the performance of those arrangements by the maintenance provider.

Once the hire period expires, the assets will need to be returned to the funder or sold to a third party. You may be entitled to a share of the sale proceeds if the funder has appointed you as its agent to sell the assets for them.

The type of lease agreement will depend on the terms agreed at the beginning and they will affect the cost payable by you overall. You will need to check the terms of any lease agreement you are offered carefully to make sure that you understand them.

You can find more information about our finance lease product in this guide on our website Finance-Lease-Product-Guide-V1-04-2023.pdf (propelfinance.co.uk/wp-content) . The guide relates to our CCA regulated product, but the information provided is also relevant to our unregulated product.

Hire Purchase

Hire Purchase (also known as “HP”) is an agreement for the hire of assets with an option to purchase them once all the repayments have been paid.

You will need to pay regular repayments over the fixed hire period. These repayments may all be for the same amount, but sometimes a more substantial ‘balloon’ repayment may be due at the end of the hire period.

During the hire period, you will have the right to keep and use the assets. You will have to insure, maintain and repair the assets and may need to replace them if they are stolen. If you do not keep to the terms of the agreement, the funder can end the agreement and take back the assets and you will have to pay compensation to ensure that the funder is repaid in full.

However, unlike a lease, if you keep to the terms of the agreement you will be entitled to become the owner of the asset at the end of the hire period, after paying an option to purchase fee. This is usually only a small amount, but some HP agreements include a larger final optional repayment. Propel’s standard option to purchase fee is detailed in the Tariff of Charges below.

You can find more information about our hire purchase product in this guide on our website. Hire-Purchase-Product-Guide-V1-04-2023.pdf (propelfinance.co.uk/wp-content)

IS ASSET FINANCE SUITABLE FOR ME?

For detailed guidance on whether asset finance is suitable for you in your current circumstances, you should speak to your accountant or other financial advisor. Propel are not financial advisors.

We offer our customers standard asset finance products, based on a limited amount of information. We do try to make sure that asset finance would not be unsuitable for a customer and some basic indicators of unsuitability are set out below. However, all customers must decide for themselves if asset finance is suitable for them.

Asset finance usually involves payment of a fixed price over a fixed period. You need to be sure you can afford to pay all the payments that will become due and are able to meet the other terms of the agreement.

If you decide you no longer need the assets, or even if they cannot be used, you will still have to either continue paying for them during this period or settle the agreement early. Funders usually offer a small discount to reflect early payment, but this is usually only a small proportion of the outstanding balance. Also, if you decide to change the asset during the fixed period, this is likely to lead to higher charges.

Asset finance is unlikely to be suitable for you if:

– You do not know whether you can afford all the payments

– You do not know whether you will need the assets for the fixed or minimum period

– The assets only have a short working life; or

– You are likely to want to change the assets during the fixed/minimum period.

For more help in deciding whether to select asset finance, see the Government’s Business Finance advice (www.gov.uk/business-support-helpline/overview)

CCA REGULATION

Asset finance agreements with incorporated bodies (limited companies, LLP’s and larger partnerships) are not protected by the Consumer Credit Act (CCA).

Asset finance agreements with sole traders, partnerships with only 2 or 3 partners and/or unincorporated associations are protected by the CCA unless (i) the total credit provided, or total of rentals payable (including VAT), is more than £25,000; and (ii) the agreement is entered into wholly or predominantly for business purposes.

Asset finance agreements with a high net worth individual (HNWI) are subject to an optional exemption. Propel does not enter into regulated agreements with individuals acting outside a business, trade or profession unless they are an HNWI, and are willing to opt out of CCA protection.

Even though such agreements would be generally outside CCA regulation:

– They would still be subject to the ‘unfair relationships’ provisions in s140A CCA; and

– The HNWI would still be a ‘consumer’ for the purposes of relevant legislation, including the Consumer Rights Act 2015.

WHAT IS PROPEL’S ROLE?

Acting as a Funder

When you apply to us for asset finance, we will decide whether to provide you with funding ourselves. Our decision will consider two factors:

– Whether the asset you wish to finance and the business sector in which you operate fall within our usual funding range; and

– Whether your financial circumstances fall within our usual funding range.

In making our decision we will look at the information you provide to us as part of the application. We may also consider the results of independent credit checks.

Propel do not recommend any asset finance product over another; neither do we decide in advance of your application the terms on which we may be willing to offer a particular finance product to you. Any offer we make will be based on our assessment of your business needs and ability to pay. You should not treat such an offer as advice or a recommendation about the suitability of the product for you.

There may be other funders and/or products available to you on different terms and you should make your own independent enquiries about the alternatives before reaching any decision about whether the finance product offered is best for you.

Acting as a Broker

Different funders have different funding ranges. If you are an incorporated entity or a partnership of 4 or more partners and we decide that we do not wish to provide you with funding ourselves, but believe that one or more of the small number of third party funders that we work with may be prepared to offer you finance, we will pass your application on to them. They will then consider the information you provided to us in support of your application, including the results of independent credit checks. This is called “acting as a broker”.

If we act as a broker, we are not providing you with financial advice. If one of the funders we work with is prepared to give you finance, we will explain to you the details of the products available and their terms. You should not treat this as advice or a recommendation about the suitability of the product for you.

There may be other funders and/or products available to you that offer different terms, and you should make your own independent enquiries about the alternatives before reaching any decision about whether the finance product offered is best for you.

COMMISSION

It is usual in the finance industry for parties to receive some form of commission payment when they make an introduction which leads to a completed finance agreement. This payment is intended to reflect the time and effort involved, which can vary between different transactions.

Where we act as the funder, we will not receive any commission payment from a third party, and the only payments you will need to make to us will be those set out in the finance agreement we offer you.

Where we act as a broker, we will not charge you a fee. If you choose to obtain finance from a funder we introduce you to, we will usually receive a commission payment from them. This will either be a fixed fee or a fixed percentage of the amount they fund. We will provide you with details of the commission payable to us on request.

Different funders we work with may pay us commission at different rates. The arrangements these funders have for the payment of commission will be taken into account when they set the finance rates which will be offered to the customers we introduce to them.

If you have been introduced to us by a third party (such as the supplier you have chosen or an asset finance broker), we may pay them a commission, whether we fund your finance arrangement ourselves or broker it to another funder. Whether or not we pay a commission to them will depend on the arrangements we have in place, but broadly:

– We usually do pay commission where you have been introduced to us by an asset finance broker or by one of our commercial partners; but

– We usually don’t pay commission where you have been introduced directly to us by a supplier.

We can provide you with further information as to whether we do in fact pay commission to a third party in respect of your particular transaction on request.

If you decide to enter into a finance arrangement with us, or with a third party funder which we introduce to you, signing the finance agreement will act as confirmation that:

– You have not been given any advice or recommendation about the suitability of the terms offered to you; and

– Commission may be payable to us and/or by us as explained above.

THE APPLICATION PROCESS

If you are dealing directly with us via our Relationship Directors, we will keep you updated on the progress of your application for finance.

If you have asked a third party (such as an asset finance broker, or the supplier you have chosen) to deal with us on your behalf, we will keep them updated on the progress of your application for finance.

An application for finance may sometimes be declined on the basis of an automated scoring system. If this happens, you can ask for the decision to be reviewed by a person.

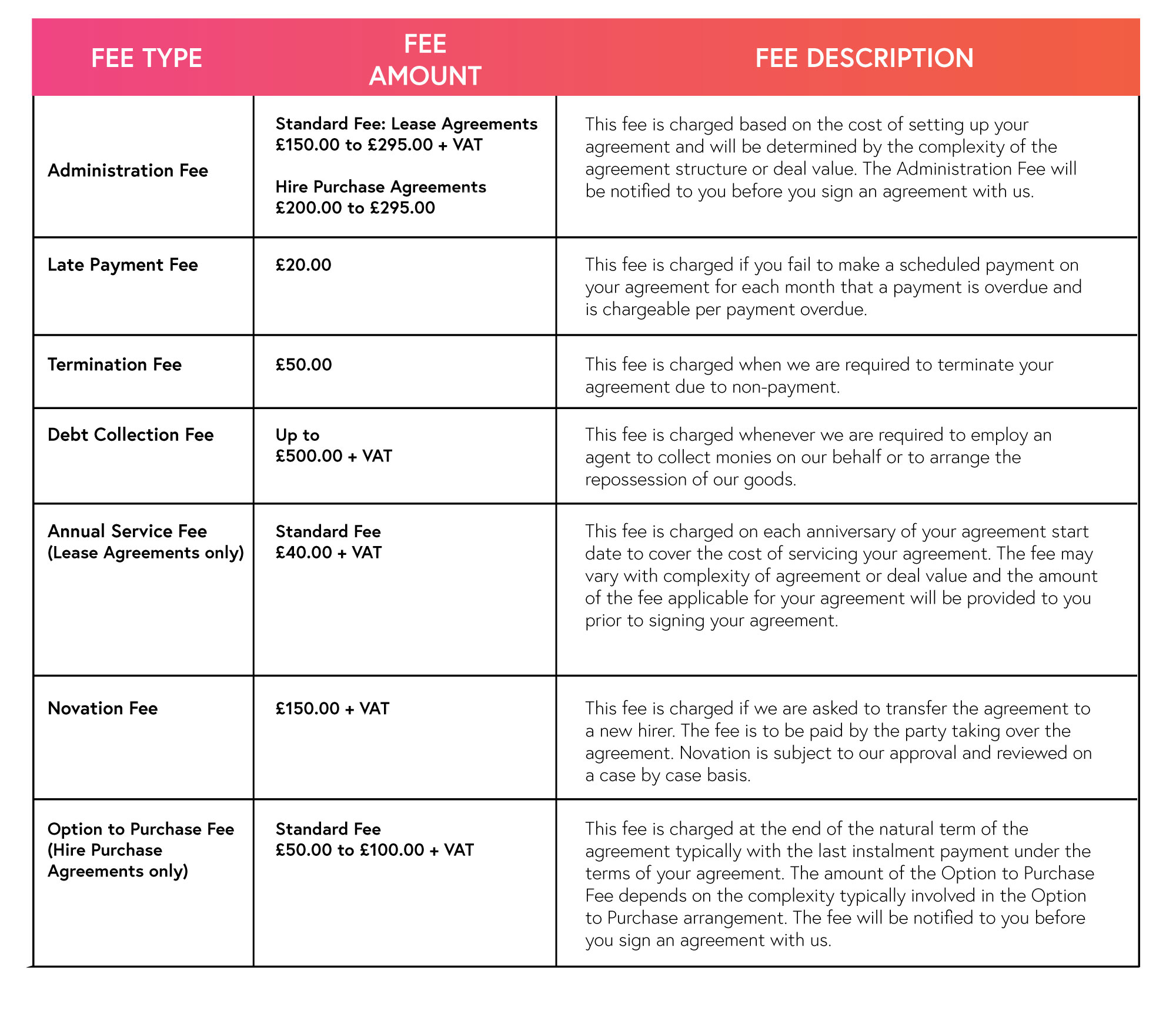

AGREEMENT FEES

We make our customers aware of the costs that may be involved with taking out a finance agreement, or during the life of any agreement you hold with us. Details of fees that may apply are set out in our Tariff of Charges which can be found below.

We have the right to change or add to our Tariff of Charges from time to time. Our up to date Tariff of Charges will be contained in the latest version of our Terms of Business, which can be found on our website here: Terms of Business – Propel Finance

COMPLAINTS RESOLUTION PROCEDURES

We are committed to excellent customer service and hope that you do not need to complain, but we accept that sometimes things go wrong.

For all customers we try to respond to all complaints quickly and fairly and have a dedicated complaints handling team to support you with this process.

We will:

– Establish the reason for your complaint quickly

– Investigate your complaint thoroughly

– Respond to you quickly

– Put things right if we have got it wrong

Some customers have enhanced protections laid out by the Financial Conduct Authority when making a complaint, including the right to have your complaint considered by the Financial Ombudsman Service. You can find out if you are one of those customers by entering some information into the Financial Ombudsman Services (FOS) website: Who we can help (financial-ombudsman.org.uk) For those customers who are covered by these enhanced protections, our complaints resolution procedures meet the standards required and a copy of these procedures is available on request, but in short:

– We will try to acknowledge and resolve your complaint within 5 working However, there will be times when this is not be possible. In that case, we will try to resolve your complaint within eight weeks as required by the Financial Conduct Authority.

– If you are unhappy with the way we have resolved your complaint, you may have the right to refer your complaint to the FOS, free of charge. The FOS will be able to review your complaint subject to their eligibility criteria, but you must refer your complaint to them within six months of the date of our Final Response Letter.

If your complaint is not referred to the FOS in time, they will not have our permission to consider your complaint and so will only be able to do so in very limited circumstances.

The FOS can be contacted as below:

Address: The Financial Ombudsman Servie, Exchange Tower, London, E14 9SR

Telephone: 0800 023 4 567

Email: [email protected]

Website: www.financial-ombudsman.org.uk/

If you have a complaint about our service, please contact us:

By Post:

Address: Propel, Complaints Resolution Team, Unit 5, Langstone Business Village, Langstone, Newport, NP18 2LH

Telephone: 01633 415 222

Email: [email protected]

ASSET PROTECTION INSURANCE

It is a requirement of all our asset finance agreements that you adequately insure our interest as owners of the assets so that they are protected if they are damaged or stolen. You are also required to show us evidence of insurance if we ask for this. If you do not do this, we have the right to take out our own insurance for the assets and pass the cost on to you. If we do this, it does not mean that you would be an insured party and you would not be entitled to any benefit payable under our policy.

USE OF DATA AND PROTECTION

For details on how we use individuals’ personal data (including the directors and partners of businesses), or the data protection rights available to individuals, please see to our Fair Processing Notice which can also be found at www.propelfinance.co.uk/fair-processing-notice/

CREDIT REFERENCE AGENCY

We currently use ‘Experian’ to carry out our credit searches. Their details are as follows:

Customer Support Centre, Experian Ltd, PO Box 8000, Nottingham, NG8 07W

If you have experienced problems obtaining credit, we recommend you request a copy of your credit file.

If you would like a copy of your credit report, please visit: Statutory Credit Report | Experian . You can apply for your credit report online or by completing Experian’s Statutory Credit Report Application Form and returning by post to the address shown above.

TARIFF OF CHARGES

Please find our Tariff of Charges below. If you have any queries regarding these charges, please contact our Customer Service Team on 01633 415 222.

TERMS OF BUSINESS V12.07.2024