Financing your future with Asset Finance

For 30 years, Propel has provided finance to more than 50,000 UK SMEs, granting them access to a large range of machinery, equipment and vehicles.

Propel supports UK SMEs across all major sectors, offering a comprehensive suite of asset finance solutions tailored to each customers' needs.

Propel has partnered with some of the largest technology resellers and is the trusted partner for the likes of Barclays Business Banking and Azets.

For further details, please see below:

Our Finance Solutions

-

After making all payments (including the option to purchase fee), you become the owner of the asset. Discover More

-

Access the latest equipment or vehicles for a fixed monthly fee without the commitment of ownership. Discover More

-

Unlock the cash tied up in your existing assets! Discover More

Who can benefit from Asset Finance with Propel?

Limited Companies and PLCs

Sole Traders

Partnerships and LLPs

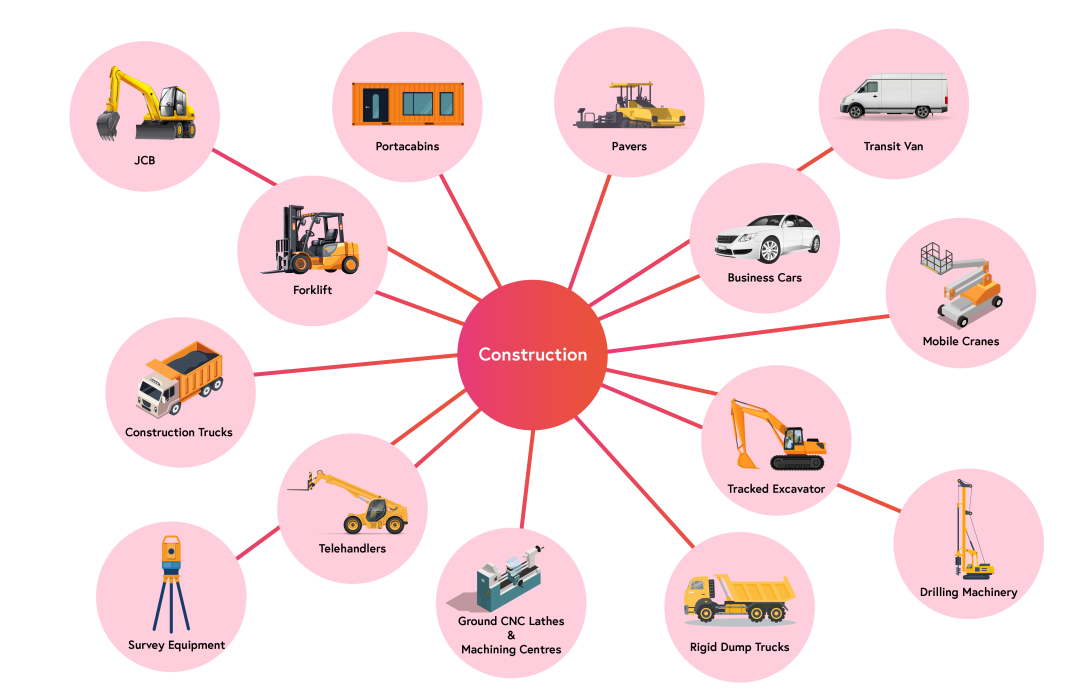

Propel supports a wide range of industries, such as:

- Backhoe Loaders

- Bulldozers

- Compactors

- Concrete Mixers and Pumps

- Cranes

- Crushers

- Demolition Equipment

- Drilling Machinery

- Dump Trucks

- Excavators

- Graders

- Pavers

- Portacabins

- Scaffolding Equipment

- Scrap Handlers

- Screeners

- Survey Equipment

- Tools

- Vehicles

- Wheeled Loaders

- And much more!

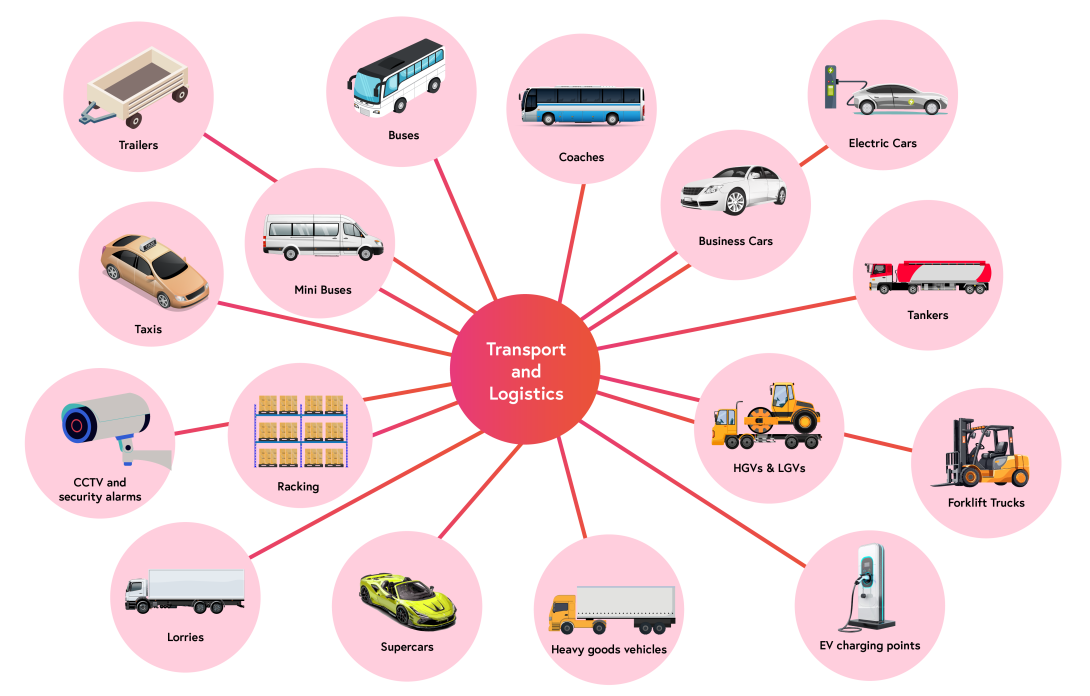

- Articulated lorries

- Buses

- Cars

- Cabs

- Coaches

- Conveyors

- Cranes

- EV charging points

- Flatbed lorries

- Fork-lift trucks

- Garage equipment

- Hearses

- IT equipment

- LED lighting

- Lorry lifters

- Low loaders

- Manual pallet trucks

- Materials handling

- Order pickers

- Racking

- Storage and pallet racking

- Tankers

- Tippers

- Trailers and semitrailers

- Trucks (HGVs)

- Tautliner (Curtain-sided) trucks

- Telehandlers

- Vans (LCVs)

- Wide load lorries

- Winches

- And much more!

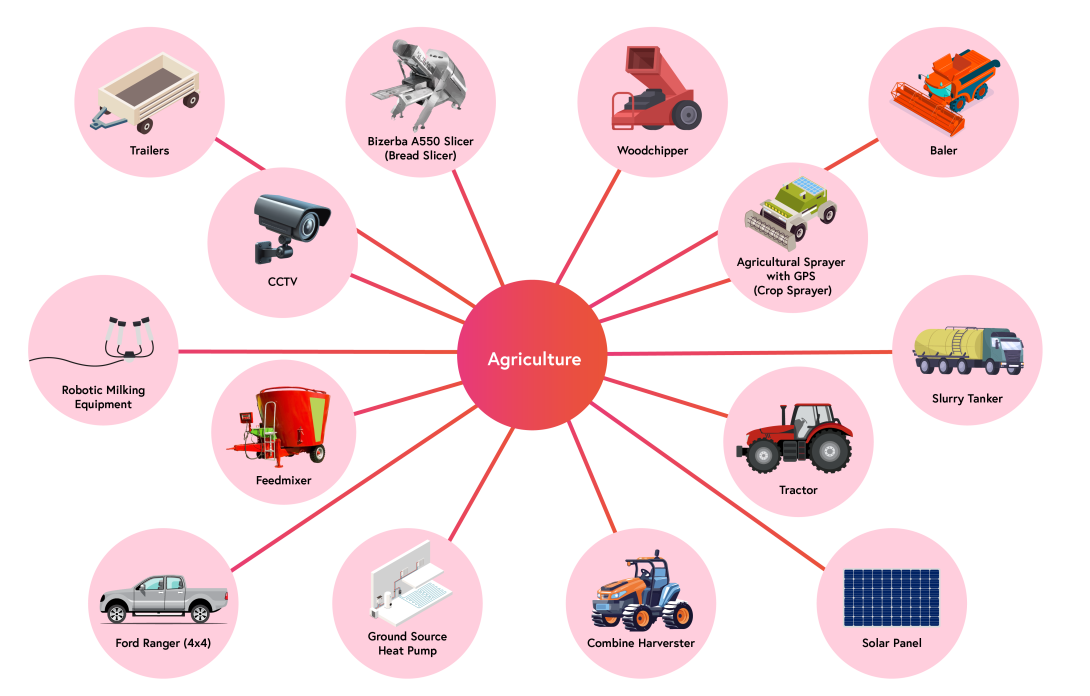

- ATVs

- Balers

- CCTV

- Combine Harvesters

- Commercial Vehicles

- Crop Sprayers

- Destoning Equipment

- Drones

- Farm Shop Fit-Outs

- Feed Mixers

- Food & Drink Production Equipment

- Forage Harvesters

- Handling Machinery

- Haulage Vehicles

- IT Systems

- LED Lighting

- Mowers

- Packaging Equipment

- Production Machinery

- Recycling Equipment

- Renewables

- Tankers

- Telehandlers

- Tractors

- Trailers

- Workshop Facilities

- And much more!

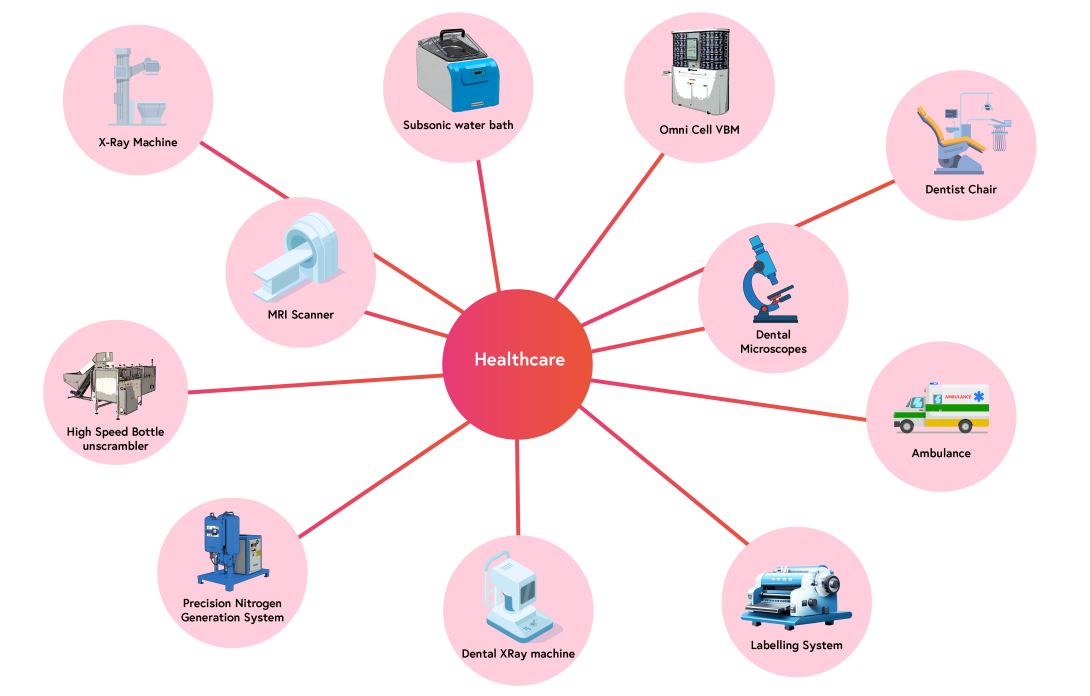

- 3D modelling and digital impression systems

- Anaesthetic equipment

- Chairs and treatment centres

- Chiropractic equipment

- Compressors and articulators

- CT, MRI and X-Ray machines

- Defibrillators

- Dental equipment

- Digital chairside dentistry

- Endoscopy equipment

- IT equipment

- Laboratory equipment

- Loupes and handpiece systems

- Operating theatre equipment including lighting, tables, and instruments

- Optical equipment

- Passenger transport ambulances

- Patient lifting and assistance equipment

- Scanners and imaging equipment

- Spectrophotometers

- Specialised cranial equipment

- Sterilisation units

- (Autoclaves) / Decontamination equipment

- Surgery / dental cabinetry

- Ultrasound equipment

- Vehicles

- Veterinary equipment

- And Much More!

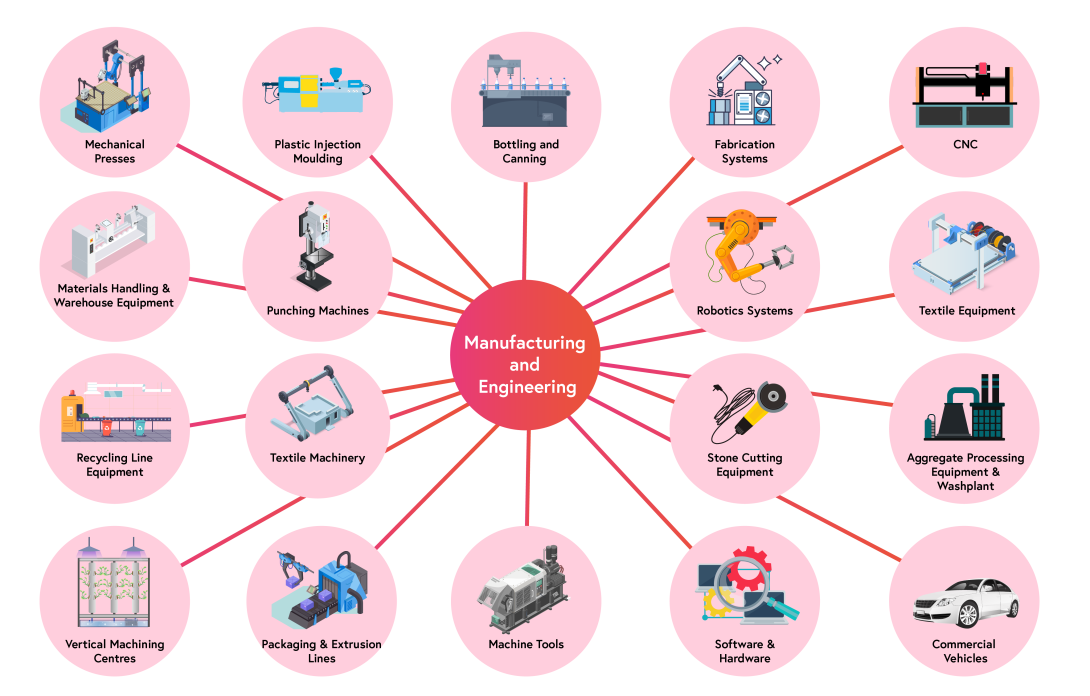

- Processing equipment

- Machine tools

- Mechanical presses

- Plastics injection moulding

- 3D printing

- Fabrication systems

- Bottling and canning plant

- Food & Dairy production and processing line equipment

- Packaging & extrusion lines

- CNC Machinery

- Materials Handling & warehouse equipment

- Punching machines

- Robotics systems

- Textile equipment

- Vertical machining centres

- Software & hardware

- Recycling line equipment

- Textile machinery

- Stone cutting equipment

- Aggregate processing equipment & washplant

- Commercial Vehicles

- And much more!

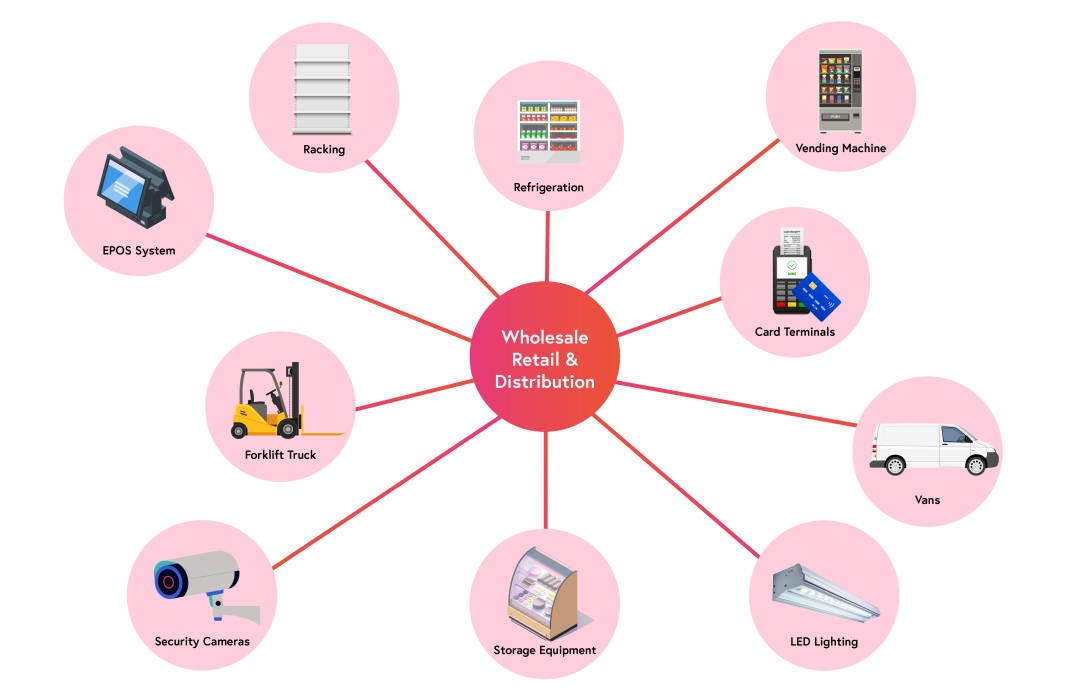

- Air conditioning

- Card Processing Terminals

- Catering Equipment

- Commercial Vehicles

- Conveyor belts

- Epos Systems

- Fixture and Fittings

- Forklifts

- Hosted Telecoms

- IT Equipment

- LED Lighting

- Office Equipment/Furniture

- Printing Equipment

- Refrigeration

- Security Equipment

- Solar Panels

- Storage and Racking

- Vending Machines

- Warehouse Management Technology

- And Much More!

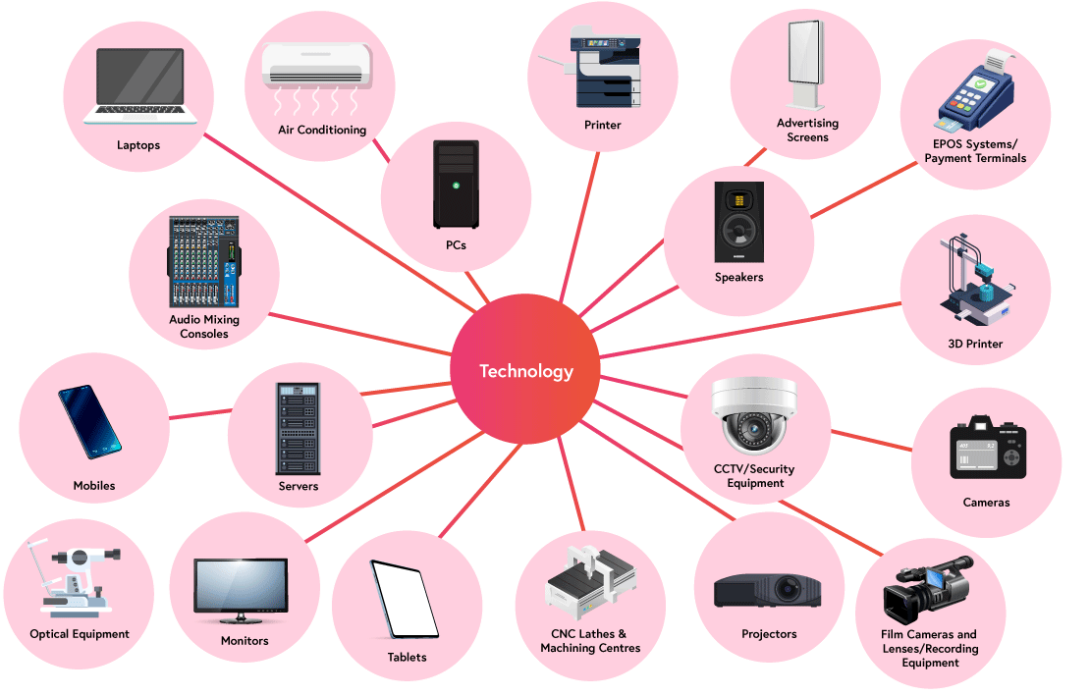

- 3D Printers

- Advertising Screens

- Air Conditioning

- Audio Mixing Consoles

- Cameras

- CCTV / Security Equipment

- CNC Lathes & Machining Centres

- EPOS Systems / Payment Terminals

- Film Cameras and Lenses

- Laptops

- Mobiles

- Monitors

- Optical Equipment

- PCs

- Printer

- Projectors

- Recording Equipment

- Servers

- Speakers

- Tablets

- And Much More!

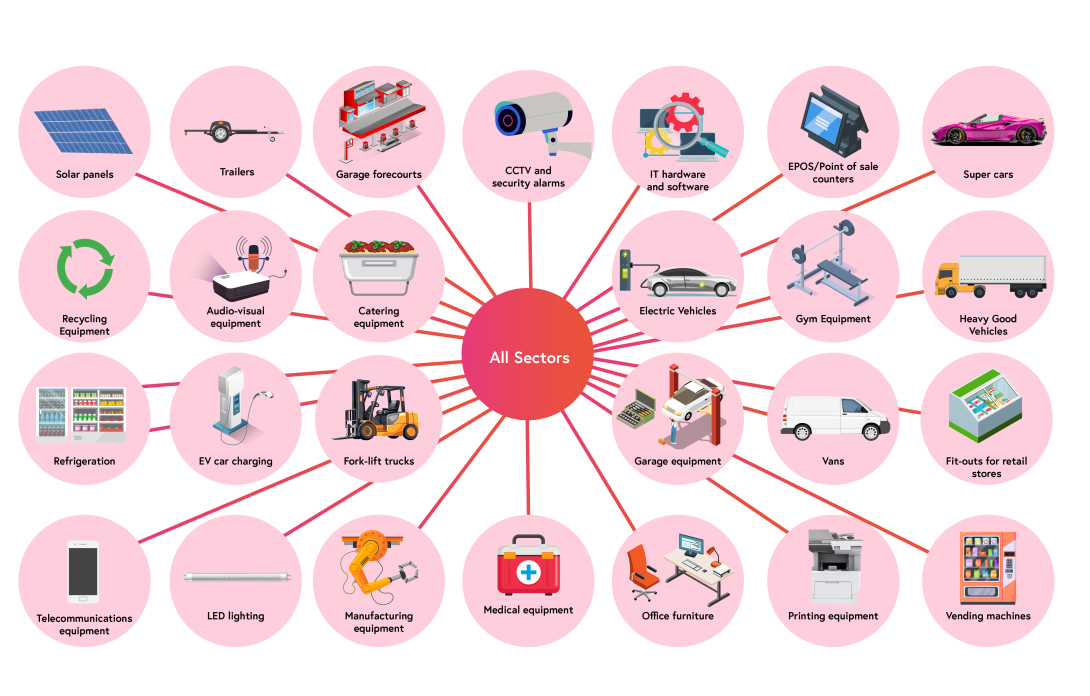

- Audio-visual equipment

- Catering equipment

- CCTV and security alarms

- Electric cars and vehicles

- EPOS/Point of sale counters

- EV car charging

- Fit-outs for retail convenience stores

- Fork-lift trucks and materials handling equipment

- Garage forecourts

- Garage equipment

- IT hardware and software

- LED lighting

- Manufacturing and industrial equipment

- Medical equipment

- Office furniture

- Plant and machinery

- Printing equipment

- Recycling equipment

- Refrigeration

- Solar Photovoltaic (PV) panels

- Telecommunications equipment

- Tractors and trailers

- Vending machines

- Vehicles, cars trucks and vans

- Yellow plant

- And much more!

Get in touch with our experts today!

We're here to help you drive your business forward by delivering the competitive asset finance solutions you need - when you need them.

If you would like to talk to the Propel Sales Team, please call us today on 01633415222 and select Option 1.

Alternatively, you can simply complete the enquiry form to the left.

Fields marked with an * are required.

We look forward to working with you.

So we can understand your requirements, we will need to gather some information from you.

Any personal information submitted to Propel via this route will only be used for the purposes of servicing your enquiry. If you would like further details of how we process your data, please read our Privacy Policy and Fair Processing Notice.

Finance is subject to status. Terms and Conditions Apply. Propel acts as a lender or a credit broker for business customers only.

Propel Finance Plc is registered in Wales, Company no 04015132. Propel Finance No. 1 Limited is registered in Wales, Company no 10003271. Registered offices are at Unit 5, Langstone Business Village, Langstone Park, Newport, NP18 2LH. Propel Finance Plc and Propel Finance No.1 Limited are authorised and regulated by the Financial Conduct Authority